You probably guessed what I would say based on my profession. Yes, the obvious answer is real estate, not just because I work in the industry, but because I practice what I preach.

About 10 years, I had a choice to make: either buy mutual funds and hope that they go up in value or purchase a tangible asset that could grow in value through leverage. Let’s use simple math and conservative numbers to make sense of what I am saying.

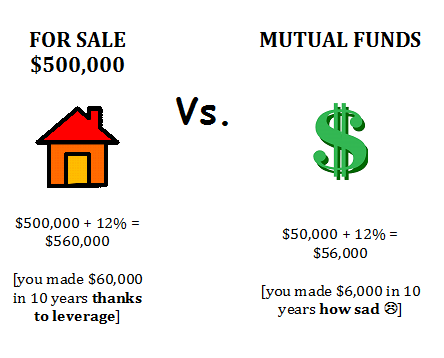

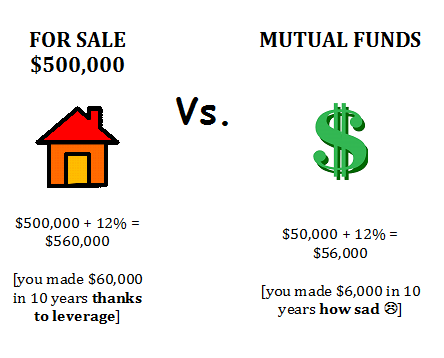

ASSUME you have $50,000 to invest. You qualify to purchase a property worth $500,000. So do you invest in an intangible asset (mutual funds) or a tangible asset (property)?

So by how much did each investment go up?

So by how much did each investment go up?

In real estate, the appreciation is calculated not on your initial investment, but rather on the entire value of the asset when you purchase it – LEVERAGE IS YOUR BEST FRIEND!

So you might be asking, what about risk?

Both kinds of investments come with their inherent risks.

With your Real Estate investments, you take on the responsibilities of being a landlord (sweat equity required) and the potential stress of a short-term shift in market value. As well, it’s imperative to remember that Real Estate is not a liquid investment – the state of the market will determine how quickly you are able to resell when the time comes.

As for mutual funds, different risks emerge depending on the kind of security purchased by the fund. It’s widely understood that it is a risk that you can lose money with mutual funds. As well, it’s important to know that because they are securities - and not deposits - they are not guaranteed or insured by the Canada Deposit Insurance Corporation or any other governmental agency.

In my experience, many investors do prefer the advantages and relative stability provided by their Real Estate investments, as well as the opportunity to leverage longer-term financial gains.

Whether you choose to invest in Real Estate or in mutual funds, both kinds of investments require due diligence and research. I always advise my clients that any investment decision they make should be part of a larger financial plan – taking your whole financial picture into perspective!

Want to know more? Be sure to reach out today – we can go over your options over coffee. My treat!

Cheers,

Karen Biffi

Proud mom & Realtor ®